Credit card expense management is the monitoring, controlling and optimizing the use of credit cards within an organization or for personal financial management. This practice is relevant for individuals and businesses using credit cards for transactions. The goal is to manage and monitor expenses effectively, ensure responsible spending, and streamline the financial process. Credit card expense management is a comprehensive approach to overseeing and optimizing the use of credit cards for financial transactions, whether on an individual or business level.

In this article, we will examine what expense management is, corporate card expense management for improved efficiency, business credit card expense management, the rise of credit card expense management apps, corporate credit card expense management software, credit card expense tracking software, what credit card statements are, setting a budget in credit card expense management, paying in full vs. minimum payments, creating and following a spending plan for credit card expense management, managing multiple credit cards, finding the right credit card expense management provider and finally the top companies that provide the credit card expense management.

- What is Expense Management?

- Expense Report Software

- Expense Tracking Software

- Expense Management Software for Small Business

- Best Expense Management Software

- Expense Reimbursement Software

- Credit Card Expense Management Software

- Corporate Travel Management Software

- Business Expense Software

- Expense Automation Software

- Managing Expenses for Small Business

- Expense Management Workflow

- Employee Expense Management

- Corporate Travel Expense Management

- Travel and Expense Solutions

- Corporate Card Expense Management for Improved Efficiency

- Business Credit Card Expense Management

- The Rise of Credit Card Expense Management Apps

- Corporate Credit Card Expense Management Software

- Credit Card Expense Tracking Software

- What are Credit Card Statements?

- Setting a Budget in Credit Card Expense Management

- Paying in Full vs. Minimum Payments

- Creating and Following a Spending Plan for Credit Card Expense Management

- Managing Multiple Credit Cards

- Finding the Right Credit Card Expense Management Provider

- Top Companies Providing Credit Card Expense Management

- Conclusion

- Credit Card Expense Management FAQ

What is Expense Management?

Expense management refers to the process businesses use to track, oversee, and control spending to keep the company within its budget and increase its operational efficiency. Effective expense management helps organizations control costs, prevent fraud, and optimize spending policy to align with strategic financial goals. Many expense management platform companies use specialized software solutions to automate and streamline the expense management process.

Expense Report Software

Expense report software simplifies the creation, submission, and approval of expense reports. This tool helps ensure accuracy and compliance with company policies, making it easier for employees and finance teams to handle expense reporting without hassle.

Expense Tracking Software

Expense tracking software provides real time insights into spending patterns, enabling continuous expenditure monitoring. This software is essential for maintaining budget controls and preventing financial leakages.

Expense Management Software for Small Business

Small businesses benefit from expense management software designed to fit limited budgets and more straightforward operational needs. These solutions often offer basic functionalities like tracking receipts, categorizing expenses, and generating reports.

Best Expense Management Software

The best expense management software typically combines user-friendliness with powerful analytics, accounting integrations capabilities, and mobile access. Such corporate credit card expense management platforms enable businesses to manage expenses more effectively and make informed financial decisions.

Expense Reimbursement Software

This type of software facilitates the process of compensating employees for out-of-pocket expenses. It corporate credit card expense management automates the workflows needed to approve, track, and reimburse these expenses, thereby reducing administrative burdens and improving employee satisfaction. The expense platform automates expense approval and processes employee reimbursements in detail.

Credit Card Expense Management Software

This software integrates credit card transactions into the expense management process, helping businesses monitor and control credit card spending and ensure it aligns with corporate expense policies.

Corporate Travel Management Software

Corporate travel management software is designed to handle aspects of business travel, including booking, expense submissions, and standard expense policy compliance. It offers travelers and corporate travel managers tools to streamline travel-related processes.

Business Expense Software

General business expense software offers tools to capture, manage, and report all types of business expenses, providing a bird’ s-eye view of the company’s financial expenditures.

Expense Automation Software

This software automates repetitive tasks in the expense management cycle, such as data entry and report generation. It enhances efficiency and accuracy, allowing finance teams to focus on more strategic tasks.

Managing Expenses for Small Business

Managing expenses efficiently without the complexity of larger corporate credit card expense management systems is crucial for small businesses. Solutions tailored for small enterprises often focus on ease of use, affordability, and essential functionalities.

Expense Management Workflow

An optimized expense management workflow ensures that all steps, from expense capture to report approval, are streamlined and efficient. different credit card expense management software solutions help in designing these workflows to match organizational needs.

Employee Expense Management

A comprehensive approach to managing all employee-incurred expenses can be achieved with dedicated software that covers everything from travel expenses to petty cash and entertainment.

Corporate Travel Expense Management

Focusing specifically on travel expenses, this software provides tools for pre-travel approvals, on-travel spending, and post-travel reporting, helping companies manage travel costs effectively.

Travel and Expense Solutions

These solutions provide integrated corporate card expense management platform for managing travel booking and associated expenses, offering a seamless experience for business travelers and finance departments.

With various corporate card expense management software solutions, businesses can choose the right corporate credit card tool to suit their needs. Whether it’s simplifying the reimbursement process, integrating credit card expenses, or managing corporate travel, the right expense management software can significantly affect how financial operations are conducted. Selecting the appropriate capable credit card expense management software will ensure compliance and accuracy and contribute to overall economic health and operational efficiency.

Corporate Card Expense Management for Improved Efficiency

Corporate expense cards, often business credit cards, are crucial in facilitating day-to-day operations. Integrating these physical cards into a centralized corporate expense management system further enhances operational efficiency. By doing so, businesses can monitor individual card transactions, set spending limits, and gain better control over overall expenditure. Corporate debit cards offer multiple advantages, including more employee flexibility and clear budget ownership.

Business Credit Card Expense Management

Business credit card statements can be intricate, requiring meticulous scrutiny to extract meaningful insights. Fortunately, with the right business credit card expense management tools, interpreting these statements becomes more straightforward. These corporate card solution offer categorization, analysis, and visualization features that transform raw financial data into actionable intelligence.

The Rise of Credit Card Expense Management Apps

In an era dominated by mobile technology, credit card expense management apps have become invaluable tools for on-the-go financial control. These apps allow users to track expenses, submit receipts, and manage corporate card transactions from the convenience of their smartphones. The accessibility and user-friendly interfaces make these apps essential to any modern corporate credit card expense management strategy.

Popular Expense Management Apps

In today’s fast-paced world, effectively managing your finances, especially credit card expenses, can be significantly facilitated using the right card expense tools. Several expense management apps are available that help users monitor their spending, create budgets, and even provide insights on optimising their finances. These apps are designed to cater to various needs, whether you are a meticulous budgeter looking for detailed tracking or someone who needs a simple corporate credit card expense management system to ensure they don’t overspend.

| App Name | Features | User Rating |

| Mint | Budgeting, tracking, alerts | 4.5/5 |

| YNAB | Detailed budgeting, goal tracking | 4.8/5 |

| Quicken | Investments, budgeting, bill management | 4.3/5 |

Choosing the right expense management app can transform how you handle your credit card expenses, turning a stressful part of personal finance into a manageable and even rewarding task. Whether you opt for Mint’s all-encompassing budget alerts and free access, YNAB’s goal-oriented approach, or Quicken’s investment tracking capabilities, each app offers unique features tailored to different financial needs and goals. Integrating these tools into your daily financial routine allows you to gain greater control over your spending, improve your budgeting skills, and ultimately achieve a more stable and prosperous economic future.

Corporate Credit Card Expense Management Software

The use of corporate credit cards is commonplace in businesses of all sizes. However, as the number of transactions increases, so does the need for effective tracking and control. This is where corporate credit card expense management software becomes a game-changer. These sophisticated tools offer a comprehensive solution for businesses to seamlessly monitor, analyze, and optimize their financial credit card transaction.

Benefits of Corporate Credit Card Expense Management Software

Corporate credit card expense management software offers myriad benefits, streamlining financial processes and enhancing overall operational efficiency for businesses. One significant advantage is the accounting automation of expense tracking and reporting, reducing the manual burden on employees and finance teams. This software allows for real-time monitoring of transactions, ensuring greater visibility into company expenditures. Enhanced reporting features enable detailed insights into spending patterns, aiding strategic decision-making and budget optimization. By leveraging corporate credit card expense management software, businesses can save time and resources, fortify financial controls, and promote responsible spending practices.

- Streamlined Processes: Corporate credit card expense management software streamlines the entire expense tracking process, reducing the manual effort required for reconciliation and reporting.

- Real-time Monitoring: Businesses can monitor expenses in real-time, gaining valuable insights into spending patterns and making informed decisions promptly.

- Policy Compliance: Ensure adherence to company expenses policies with built-in features that flag non-compliant transactions, providing a proactive approach to policy enforcement.

- Enhanced Reporting: Generate detailed reports effortlessly, offering a comprehensive overview of corporate spending facilitating better financial planning and decision-making.

Corporate credit card expense management software is a transformative tool for modern businesses, offering a range of invaluable benefits. The real-time monitoring and robust reporting features empower businesses with insights crucial for informed decision-making and strategic planning. The seamless integrations with accounting systems further enhances the financial ecosystem, simplifying account reconciliations processes and expediting expense reimbursements. Adopting corporate credit card expense management software is not merely a technological upgrade but a strategic investment that paves the way for enhanced control, transparency, and financial health within enterprises.

Credit Card Expense Tracking Software

Businesses can access credit card expense tracking software beyond basic tracking functionalities. These tools offer advanced features such as receipt management, ensuring every transaction is documented seamlessly. The ability to link receipts to specific transactions simplifies auditing and provides a transparent trail for financial scrutiny.

As businesses continue to evolve, so should their financial management practices. Implementing robust credit card expense management solutions, whether in software, apps, or integrated systems, is no longer a luxury but a necessity for maintaining financial health and fostering sustainable growth. Embracing these tools ensures that businesses can easily navigate the complexities of credit card expense management, allowing them to focus on what matters most – achieving their strategic objectives.

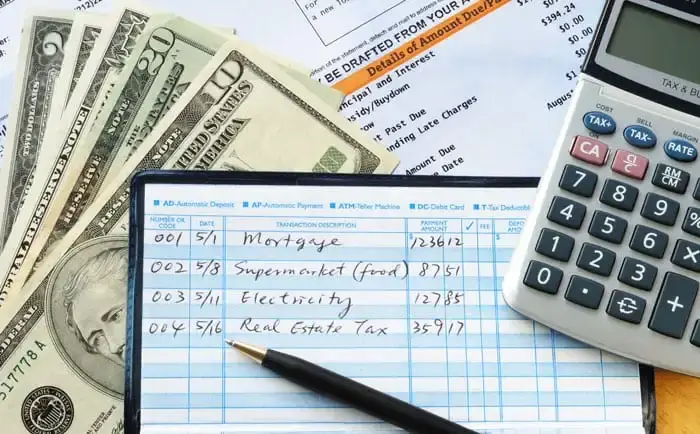

What are Credit Card Statements?

Understanding your credit card statement is crucial for managing your finances effectively and avoiding unnecessary expensive fees or credit card charges. While the specific format may vary between credit card issuers, most statements include common elements. Here’s a general guide to help you understand a typical credit card statement:

- Account Information:

- Account Summary: This section provides an overview of your account, including the previous balance, payments, purchases, cash advances, card transaction fees, and the current balance.

- Transaction Details:

- Transaction List: This section itemizes all transactions made during the billing cycle. Each transaction should include the date, description of the purchase, and the amount spent.

- Merchant Information: The merchant’s name and location where the transaction occurred.

- Payment Information:

- Minimum Payment Due: You must pay by the due date to avoid late fee and maintain your account in good standing.

- Payment Due Date: The date you must make the minimum payment.

- Total New Balance: The total amount you owe on your credit card, including purchases, cash advances, and platform fees.

- Credit Limit and Available Credit:

- Credit Limit: The maximum amount you can withdraw from your credit card.

- Available Credit: The remaining credit you have known before reaching your limit.

- Interest Charges:

- Annual Percentage Rate (APR): The annualized interest rate applied to your outstanding balance. Annual Percentage Rate is the cost of borrowing on the card.

- Interest Charges: The total interest accrued on your balance during the billing cycle.

- Fees:

- Late Payment Fees: Charges incurred for not paying at least the minimum amount by the due date.

- Overlimit Fees: Fees are charged if your balance exceeds the credit limit.

- Cash Advance Fees: Charges for withdrawing cash using your credit card.

- Other Fees: Additional fees, such as balance transfer or foreign transaction fees.

- Reward Points or Cash Back (if applicable): Details any rewards or cash back earned during the billing cycle.

- Grace Period: The time between the end of the billing cycle and the due date, during which you can pay the balance in full to avoid interest charges.

- Contact Information: Customer service contact information for inquiries or assistance.

- Important Notices: Any crucial messages or updates from the credit card issuer.

Reviewing your credit card statement regularly is essential to ensure accuracy, detect unauthorized transactions, and stay informed about your financial status. If you have questions or notice discrepancies, promptly contact your credit card issuer. Consider setting up account alerts or notifications to stay on top of your credit card activity.

Setting a Budget in Credit Card Expense Management

Effective credit card expense management begins with a well-defined budget that serves as a financial roadmap. A budget helps you track your spending and ensures that you allocate your resources in a way that aligns with your financial goals. Regarding credit cards, a budget becomes crucial to prevent overspending, manage debt responsibly, and make informed financial decisions.

Creating and sticking to a budget is fundamental to effective credit card expense management. Here’s a step-by-step guide on how to set a budget for your credit card expense management:

- Assess Your Finances: Start by understanding your overall financial situation. Calculate your monthly income and list all your fixed expenses (rent/mortgage, utilities, insurance) and variable expenses (groceries, dining out, entertainment).

- Categorize Expenses: Categorize your expenses into essential (needs) and non-essential (wants). This will help you prioritize and identify areas where you can cut back if needed.

- Set Spending Limits: Based on your assessment, set realistic spending limits for each category. Ensure that your total planned credit card spending aligns with your overall budget.

- Emergency Fund Allocation: This fund can be used to cover unexpected expenses, reducing the likelihood of having to rely on your credit card for emergencies.

- Account for Debt Repayment: If you have outstanding credit card debt, allocate a specific portion of your budget to repay it. Focus on paying more than the minimum amount due to reduced interest charges.

- Utilize Budgeting Tools: Consider using budgeting tools or apps to help you track your spending. Many apps categorize transactions, provide spending insights, and alert you when approaching your budget limits.

- Prioritize Debt Repayment: If you have multiple credit cards, prioritize paying off high-interest debt first. Allocate more funds to the card with the highest interest rate while making minimum payments on others.

- Avoid Impulse Purchases: Stick to your budget to avoid impulse purchases. Before making a non-essential purchase, consider if it aligns with your financial goals and whether you can afford it within your budget.

- Save for Future Goals: Allocate a portion of your budget to savings for future goals, such as a vacation, a significant purchase, or retirement. This can help prevent relying on credit for future expenses.

By following these steps and consistently monitoring your budget, you can effectively manage your credit card expenses, avoid accumulating unnecessary debt, and work towards achieving your financial goals.

Paying in Full vs. Minimum Payments

Understanding the implications of paying in full versus making minimum payments on your credit card is crucial for responsible financial management. Here’s a breakdown of the differences and considerations for each approach:

- Paying in Full of Pros:

- Build Good Credit History: Consistently paying your credit card balance in full can positively impact your credit history and score. It demonstrates responsible credit management to credit bureaus.

- Avoid Interest Charges: When you pay your credit card balance in full by the due date, you typically avoid accruing interest on your purchases. Credit cards often have an interest-free grace period if the balance is paid on time.

- Financial Discipline: Paying in full requires discipline and financial awareness. It ensures that you only bill spend what you can afford to pay off, reducing the risk of accumulating debt.

- Paying in Full of Con:

- Cash Flow Impact: Paying in full may impact your immediate cash flow, as you need to cover the entire credit card balance. Ensure you have sufficient funds in your bank account to cover the payment.

- Minimum Payments of Pros:

- Maintain Credit Standing: Making at least the minimum payment keeps your credit account in good standing, preventing late fees and negative impacts on your credit report.

- Short-Term Financial Relief: Making minimum payments provides short-term relief by allowing you to meet the minimum requirement without paying the total balance.

- Minimum Payments of Cons:

- Accrual of Interest: If you only make the minimum payment, the remaining balance on your credit card accrues interest. Over time, this can lead to substantial interest charges, making your purchases more expensive.

- Negative Impact on Credit Score: While making minimum payments prevents immediate adverse effects on your credit score, carrying a high balance relative to your credit limit can negatively impact your various credit card utilizations ratio, affecting your credit score over time.

- Debt Accumulation: Relying solely on minimum payments can result in a cycle of debt, especially if you continue to make new purchases. The outstanding balance can snowball, leading to long-term financial challenges.

- Considerations:

- Financial Situation: Evaluate your current financial situation. Doing so is generally advisable if you can pay the entire balance without compromising your other financial obligations.

- Long-Term Goals: Assess your long-term financial goals. Paying in full aligns with a more financially responsible and sustainable approach, helping you avoid unnecessary debt and interest charges.

- Budgeting: Incorporate credit card payments into your budget. This ensures you allocate funds for credit card payments without compromising other essential expenses.

- Interest Rates: Consider the interest rates on your credit cards. Paying the minimum may result in significant interest charges over time if you have high-interest debt.

Paying your credit card balance entirely is the ideal approach to avoid interest charges and maintain financial health. If circumstances make it challenging to pay in full, strive to pay more than the minimum to reduce interest and work towards eliminating the balance over time. Reviewing your budget and credit card statements can help you make informed decisions based on your financial goals and situation.

Creating and Following a Spending Plan for Credit Card Expense Management

Developing and adhering to a comprehensive spending plan is essential for effective credit card expense management. A well-crafted spending pricing plans helps you stay within your financial means and ensures responsible credit card usage.

Here’s a step-by-step guide to creating and following a spending plan tailored for credit card expense management:

- Evaluate Your Finances: Begin by assessing your overall financial situation. Understand your monthly income, fixed expenses (rent, utilities), and variable expenses (groceries, entertainment).

- Review Credit Card Statements: Analyze past credit card statements to identify spending patterns. Categorize expenses such as groceries, dining, entertainment, and utilities to gain insights into your consumption habits.

- Categorize Expenses: Divide your expenses into necessities (housing, utilities, groceries) and discretionary spending (dining out, entertainment). This categorization aids in prioritizing and allocating funds accordingly.

- Allocate for Savings and Debt Repayment: Prioritize allocating savings and debt repayment funds within your spending plan. This ensures you build a financial cushion and actively manage outstanding corporate credit card balances.

- Factor in Variable Expenses: Recognize that certain monthly expenses, like dining out or entertainment, may vary. Allocate a reasonable amount for variable expenses within your spending plan.

- Utilize Budgeting Tools: Leverage budgeting apps or tools to automate expense tracking. Many apps connect to your credit card accounts, categorize transactions, and provide real-time insights into your spending habits.

- Practice Responsible Credit Card Use: Use your credit card responsibly by making timely payments, understanding the terms and conditions, and avoiding unnecessary debt. Prioritize paying more than the minimum balance to reduce interest charges.

- Stay Disciplined: Discipline is the key to successful spending plan implementation. Be mindful of your financial goals, resist impulse purchases, and stay focused on maintaining a healthy financial balance.

Adopting and adhering to a well-thought-out spending plan is fundamental to effective credit card expense management. By meticulously tracking your income, categorizing expenses, and setting realistic budget limits, you gain financial control and peace of mind. This disciplined approach helps you prioritize your spending, avoid unnecessary debt, and confidently work toward financial goals. You can cultivate responsible credit card usage through commitment, awareness, and strategic planning, paving the way for a more secure and financially sound future.

Managing Multiple Credit Cards

Effectively managing multiple credit cards requires a thoughtful and organized approach to ensure financial stability and responsible credit use. Begin by clearly understanding each card’s terms, including interest rates, credit limits, and rewards programs. Monitoring your credit score and staying informed about changes in credit card terms or rewards programs enables you to adapt your strategies to optimize benefits and financial well-being. Regular reviews and adjustments ensure that managing multiple credit cards remains a proactive and practical part of your financial plan.

Managing multiple credit cards requires careful organization and financial discipline to use Credit responsibly and avoid pitfalls. Here are some important tips for effectively managing multiple credit cards:

- Keep Track of Due Dates: Note the due dates for each credit card to avoid late payments. Late payments can result in fees and negatively impact your credit score. Consider setting up reminders or automatic payments to stay on due dates.

- Review Statements Regularly: Review your credit card statements to verify transactions and identify unauthorized or fraudulent activity. If there is a discrepancy, notify your credit card issuer immediately.

- Utilize Credit Wisely: Avoid maxing out your credit cards. Aim to keep your credit utilization ratio (the ratio of your credit card balances to credit limits) below 30% to maintain a positive impact on your credit score.

- Consider Your Credit Mix: A mix of credit types, such as credit cards and instalment loans, can positively impact your credit score. However, open new credit accounts sparingly, as each application can temporarily decrease your credit score.

- Understand Rewards Programs: If your credit cards come with rewards programs, familiarize yourself with the earning and redemption structures. Tailor your spending to maximize rewards, and consider consolidating tips from different cards.

- Consolidate Balances Carefully: If you have multiple credit cards with outstanding balances, consider consolidating them carefully. Options include transferring balances to a card with a lower interest rate or utilizing a personal loan. Be aware of these options’ balance transfer fees and interest rates.

- Limit New Credit Applications: Avoid applying for new credit cards frequently. Each credit inquiry can have a temporary impact on your credit score. Only apply for new Credit when necessary and when you can handle additional Credit responsibly.

- Close Unused Cards Strategically: Do so strategically if you close a credit card account. Closing a card can impact your credit utilization ratio, so keep older versions open to maintain a positive credit history.

- Emergency Fund: It is important to create an emergency fund to cover unexpected expenses. Relying on credit cards in emergencies can lead to increased debt.

Effectively managing multiple credit cards requires a proactive approach and a solid understanding of your financial situation. By staying organized, making payments on time, and using Credit responsibly, you can enjoy the benefits of multiple credit cards without falling into financial stress.

Finding the Right Credit Card Expense Management Provider

Selecting the right credit card expense management provider is a pivotal decision for individuals and businesses, as it directly impacts financial efficiency and control. In today’s dynamic economic landscape, myriad options exist, each offering unique features, benefits, and potential drawbacks. Whether seeking corporate card providers to streamline personal expenses or looking for a comprehensive solution for corporate spending, finding the ideal credit card expense management partner requires careful consideration of your specific needs and preferences. In this effective credit card expense process, transparency, ease of use, robust reporting capabilities, and integration with financial tools become paramount.

Here are some critical steps and factors to consider:

- Define Your Requirements: Identify your business’s specific needs and credit card expense management requirements. Consider factors such as the number of employees, the volume of transactions, reporting needs, integration with accounting software, and any industry-specific compliance requirements.

- Scalability: Choose a credit card provider that can scale as your business grows. Ensure that the solution can accommodate increasing users, transactions, and any additional features or services you may need.

- User-Friendly Interface: The platform should be user-friendly for both administrators and employees. A simple and intuitive interface can reduce the learning curve and make it easier for employees to submit expenses and for administrators to manage and track them.

- Mobile Accessibility: Look for a provider that offers a mobile app or a mobile-responsive platform. This allows employees to submit expenses on the go and enhances the overall convenience of the credit card expense management process.

- Policy Enforcement: The credit card expense management solution should allow you to easily set and enforce expense policies. This ensures that employees adhere to spending guidelines and helps prevent unauthorized or non-compliant expenses.

- Receipt Capture and OCR Technology: Consider a solution that offers receipt capture corporate card functionality and uses Optical Character Recognition (OCR) technology. This feature can automate data extraction from receipts, reducing manual transaction data entry and minimizing errors.

- Customer Support and Training: Assess the provider’s customer support level. Additionally, check whether the provider provides training resources or sessions to help users make the most of the credit card management system.

- Cost and Pricing Structure: Understand and ensure it aligns with your budget. Consider any additional fees, such as implementation or support fees. Some corporate credit card providers offer a transparent, subscription-based pricing model, while others may charge per user or transaction.

- Integration with Accounting Software: Seamless integration with your existing accounting software (e.g., QuickBooks, Xero) is crucial for efficient expense tracking and reporting. This integration can streamline the reconciliation process and reduce manual data entry.

By carefully considering these factors, you can decide when selecting a credit card expense management provider that best fits your business requirements.

Top Companies Providing Credit Card Expense Management

Several top companies specialize in providing credit card expense management solutions, catering to businesses’ growing needs and seeking efficient ways to monitor, control, and analyze their spending. These companies significantly enhance operational efficiency and financial transparency for businesses of all sizes.

Here is a list of the best credit card expense management companies:

- Spendesk

- Divvy

- Brex

Let’s review the best credit card expense management companies in order:

Spendesk

Spendesk is a company that provides credit card spend management solutions for businesses. Spendesk offers a corporate card platform that helps companies manage their expenses, streamline the procurement process, and gain better control over their spending. With spending, users point out approval delays, problems with the virtual card’s mobile functionality, and recurring expenses that need to be automated.

Spendesk may offer corporate credit card expense management solutions that enable companies to issue physical or virtual cards to employees with customizable spending limits and controls. Spendesk typically provides tools for budgeting and reporting, allowing businesses to analyze spending patterns, track budgets, and generate financial reports.

The platform may integrate with accounting software and other financial tools to ensure seamless data flow and reconciliation. Spendesk aims to automate and simplify various aspects of the spending process, reducing manual tasks and the potential for errors. The platform often has an intuitive interface that makes it easy for employees and administrators to navigate and use the system.

Credit Card Expense Management with Spendesk

Spendesk is a platform that provides business credit card expense management solutions, including credit card expense management. Spendesk offers features that help businesses streamline their expense processes, manage company spending, and gain better control over expenses. Credit card expense management is a key aspect of these services, and here are some common features and functionalities you might find in Spendesk or similar platforms:

- Approval Workflows: Spendesk may provide workflows for expense approvals, ensuring that expenses are reviewed and approved by the appropriate individuals before reimbursement.

- Centralized Spending Control: Spendesk allows businesses to centralize control over company spending by issuing credit cards to employees. These cards can be managed and monitored through the Spendesk platform.

- Expense Tracking: The platform enables users to track and categorize company credit card expenses. This can include details such as each transaction’s date, amount, and purpose.

- Real-time Reporting: Businesses can generate real-time reports to gain insights into spending patterns, identify trends, and make informed decisions. This feature is essential for financial planning and budgeting.

- Receipt Capture: Spendesk may offer features that allow users to capture and upload receipts for each transaction. This helps maintain a complete record of expenses and facilitates compliance with accounting and tax requirements.

- Policy Enforcement: Spendesk may include policy enforcement features to ensure employees adhere to company spending policies. This can include spending limits, restrictions on certain expenses, and more.

- Integration with Accounting Software: Seamless integration with accounting software is crucial for efficient credit card expense management. Spendesk may integrate with popular accounting tools, streamlining the reconciliation process.

- Mobile Accessibility: Many credit card expense management solutions, including Spendesk, offer mobile apps that allow users to manage expenses. This can include capturing receipts, submitting expenses, and accessing real-time spending data.

Consider reading user reviews and testimonials to gain insights into other businesses’ experiences using Spendesk for credit card expense management.

To learn more about Spendesk, you can review this article: Spendesk

From this link you can visit Spendesk‘s website: https://www.spendesk.com/

Spendesk Phone Number: +33 1 82 88 38 60

Divvy

Divvy is a financial technology company focusing on business credit card expense management solutions. Their platform allows companies to manage expenses, track budgets, and streamline the expense reporting process. Divvy provides a corporate card program with features such as real-time expense tracking, automated expense reports, and budgeting tools.

Divvy Credit Card Expense Management

Divvy is a financial technology company offering a business Divvy credit card expense management platform, including a Divvy credit card. Here’s an overview of how Divvy credit card expense management works:

- Collaboration and Approval Workflow:

- Divvy allows for collaboration among team members in managing expenses.

- Approval workflows can be set up to ensure expenses comply with company policies before processing.

- Divvy Credit Card:

- Divvy provides a physical credit card for business expenses.

- The Divvy card is linked to the Divvy platform, allowing for real-time tracking and management of expenses.

- Budgeting and Spending Limits:

- Divvy allows businesses to set budgets for different expense categories.

- Spending limits can be assigned to individual employees or teams, helping to control and manage expenses.

- Virtual Cards:

- Divvy provides virtual cards for online transactions or recurring expenses.

- Virtual cards offer an added layer of security and can be easily managed within the Divvy platform.

- Receipt Capture:

- Users can capture and upload receipts directly through the Divvy mobile app.

- This helps keep digital records and ensures all necessary documentation is available for expense reporting and compliance.

- Integration with Accounting Software:

- Divvy integrates with popular accounting software, such as QuickBooks and Xero.

- This streamlines the reconciliation process, ensuring financial data is accurately reflected in the company’s accounting system.

- Rewards Program:

- Divvy may offer a rewards program where businesses can earn cashback or other incentives based on their spending patterns.

- Security Features:

- Divvy includes security features such as the ability to freeze and unfreeze cards instantly, providing an added layer of protection in case of lost or stolen cards.

Overall, Divvy credit card expense management platform aims to simplify the process of tracking, managing, and controlling business expenses, giving businesses greater visibility and control over their financial operations.

To learn more about Divvy, you can review this article: Divvy

From this link you can visit Divvy‘s website: https://getdivvy.com/

Divvy Phone Number: (855) 229-3111

Brex

Brex is a financial technology company that provides financial services and products for businesses. Brex is known for offering corporate credit cards designed specifically for startups and small to medium-sized businesses. The company aims to streamline the process of obtaining business credit cards and offers features such as credit card expense management, rewards programs, and other financial tools.

Brex Credit Card Expense Management

The Brex credit card has several features, including Brex credit card expense management tools, to help businesses better control and track their spending. Here’s an overview of Brex credit card expense management:

- Real-Time Expense Tracking: Brex provides real-time expense tracking, allowing cardholders to monitor their spending as it happens. This feature helps businesses stay on top of their financial activities and make informed decisions.

- Receipt Capture: Brex offers a capture feature that allows users to take pictures of receipts and attach them directly to transactions. This helps maintain a digital record of expenses and simplifies the reconciliation process.

- Integration with Accounting Software: Brex integrates with popular accounting software platforms like QuickBooks, Xero, and NetSuite. This integration streamlines the process of transferring expense data to accounting systems, reducing manual data entry and minimizing errors.

- Employee Spending Controls: Brex provides tools for businesses to set spending limits and controls for individual employees. This helps prevent overspending and gives administrators greater control over the company’s finances.

- Automated Expense Reports: The platform generates automated expense reports, saving time for employees and finance teams. These reports can be customized and exported for further analysis or submission.

- Rewards Program: Brex offers a rewards program that gives businesses cash back, corporate card points, or other benefits based on their spending patterns. This can be an additional incentive for businesses to use the Brex credit card for their expenses.

- Mobile App: Brex provides a mobile app that allows users to manage their expenses on the go. This includes viewing transactions, capturing receipts, and accessing real-time spending data.

Additionally, user reviews and testimonials can provide insights into the practical experiences of businesses using Brex credit card expense management.

To learn more about Brex, you can review this article: Brex

From this link you can visit Brex‘s website: https://www.brex.com/

Brex Phone Number: +1-833-228-2044

Conclusion

In conclusion, effective credit card expense management is paramount for maintaining financial health and achieving long-term fiscal goals. Individuals can gain better control over their financial resources by adopting responsible spending habits, regularly monitoring statements, and leveraging budgeting tools. It is crucial to prioritize essential expenses, avoid unnecessary debt accumulation, and capitalize on rewards programs to maximize benefits. A disciplined approach to credit card usage ultimately empowers individuals to build a positive credit history, enhance their financial well-being, and pave the way for a secure and prosperous future.

Credit Card Expense Management FAQ

Managing credit card expenses can often feel overwhelming, but it can become a straightforward and empowering process with the right strategies and tools. This FAQ section aims to provide clear, concise answers to the most common questions about credit card expense management. Find practical tips and expert advice tailored to help you manage your credit card expenses effectively and confidently.

Can I use a business credit card for personal expenses?

Yes, you can use a business credit card for personal expenses, but it’s generally not recommended due to potential complications in bookkeeping, tax reporting, and legal implications.

Can I put personal expenses on a business credit card?

Yes, you can put personal expenses on a business credit card, but it’s generally not recommended. While it’s technically allowed, it can lead to various complications, such as challenges in bookkeeping, tax reporting, and potential legal customer support issues. Using a personal credit card for personal expenses is advisable to maintain clarity and simplify financial management. Always check the terms and conditions of your credit card and consult with a financial advisor or accountant for guidance based on your specific situation.

What is the most expensive credit card?

The most expensive credit card was the J.P. Morgan Reserve Card. However, please verify this information with the latest sources, as the credit card industry is subject to change.